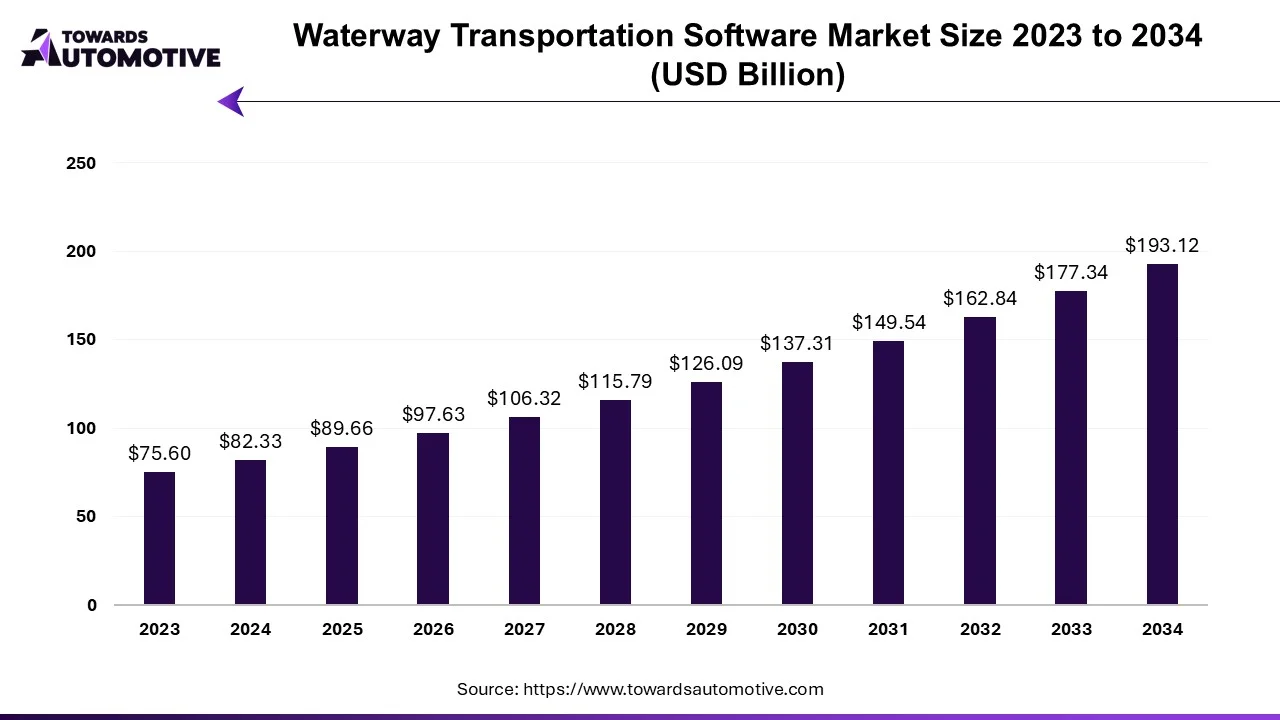

Waterway Transportation Software Market Worth USD 193.12 Bn by 2034

According to Towards Automotive consultants, the global waterway transportation software market is projected to reach approximately USD 193.12 billion by 2034, increasing from USD 97.63 billion in 2026, at a CAGR of 8.9% during the forecast period 2025 to 2034.

Ottawa, Sept. 26, 2025 (GLOBE NEWSWIRE) -- The global waterway transportation software market was assessed at USD 89.66 billion in 2025, with projections indicating an increase to USD 193.12 billion by 2034, based on insights from Towards Automotive, a sister firm of Precedence Research.

All the Stats, Charts & Insights You Need - Get the Databook Now: https://www.towardsautomotive.com/download-sample/1126

Key Takeaways

- By application, the fleet management segment dominated this industry.

- By application, the cargo tracking segment is expected to grow the fastest during the forecast period.

- By deployment, on-premise platforms dominated the market in 2024.

- By deployment, cloud-based platforms are seen to have the fastest growth.

- By functionality, real time tracking dominated the market this year.

- By functionality, compliance management is expected to be the fastest growing segment in 2024.

- By end use, the logistics companies segment held the largest share of the market.

- By end use, the port authority segment is expected to grow at the fastest rate during the forecast period.

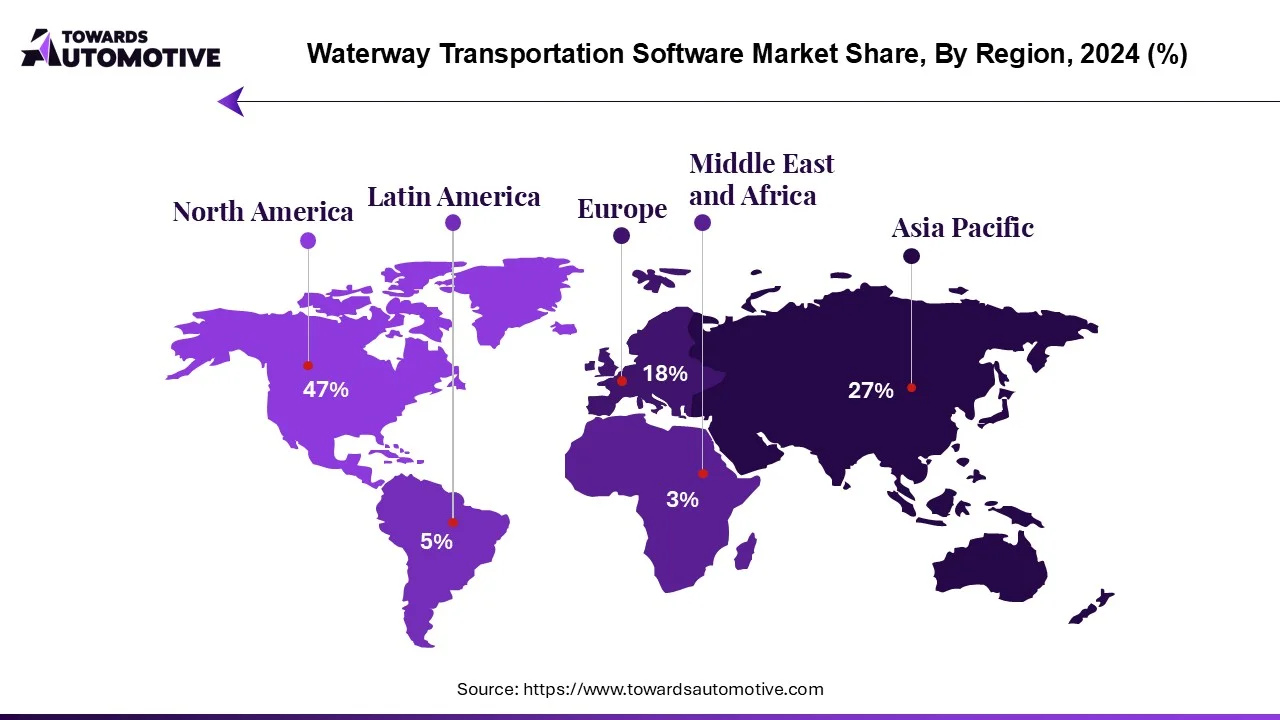

- By region, North America held the largest market share in 2024.

- By region, Asia-Pacific is estimated to grow the fastest throughout the forecast period.

Market Overview

The waterway transportation software solutions market plays a crucial role in modernizing the global logistics and shipping industries. These software systems are designed to optimize the management of maritime operations, enhance vessel tracking, improve cargo handling and streamline port operations. The growing adoption of these digital solutions is driven by the increasing demand for efficient, safe and cost-effective shipping methods, particularly as global trade continues to expand.

The emphasis on sustainability is pushing companies to find eco-friendly transport options, making waterway transportation more appealing. Additionally, advancements in technology, particularly in analytics and automation, are making these software solutions more effective.

You can place an order or ask any questions, please feel free to contact us at sales@towardsautomotive.com

Top Government Initiatives for Waterway Transportation Software Market:

| Policy / Regulation | Purpose / Key Provisions | Implications for Software Solutions / Waterway Transport Software Market |

| Inland Vessels Act, 2021 | Replaces the older 1917 Act; provides a unified legal framework for construction, survey, registration, manning, navigation, safety of inland vessels; prevention of pollution, etc. (Wikipedia) | Need for software systems to handle vessel registration, crew certification, safety compliance, pollution monitoring. Modularity in software to adapt to safety/registration regulations. |

| National Waterways Act, 2016 | Declares certain waterways as National Waterways; merges existing NWs & adds new ones; provides for regulation & development of waterways for navigation. (Wikipedia) | Growth in network creates demand for mapping/navigation software, traffic scheduling, real‑time monitoring, and intermodal integration tools. More data, more endpoints. |

| National Waterways (Construction of Jetties/Terminals) Regulations, 2025 | Regulates how permanent & temporary jetties / terminals can be constructed & operated; requires No Objection Certificate (NoC) from IWAI; mandates design standards; allows private & public entities to participate; digitises application process. (The Statesman) | Software to support NoC applications (submission, monitoring), design compliance checks, terminal operations & management, EODB (“Ease of Doing Business”) portals. Potential for dashboards, document management, GIS modules. |

| Digital Portal by IWAI under MoPSW | To facilitate private investment in development of waterways infrastructure (jetties / terminals); provides online application, tracking, transparency. (Indian Infrastructure) | Increased demand for secure, scalable, user‑friendly web apps; integration with backend systems; APIs for permit approval & notifications; data‑analytics to predict application loads etc. |

| Declaration of 101 Additional Inland Waterways as National Waterways | Government approved the enactment of central legislation to declare these waterways as National Waterways. Aim: facilitating intermodal logistic supply chains, enabling business opportunities in areas like dredging, barge operation, terminal construction etc. (Prime Minister's Office India) | Software market opportunity expands into new geographies; need for mapping, vessel routing, scheduling in more waterways; demand for logistics software, asset management, maintenance, dredging monitoring. |

| Sagarmala Programme | Flagship programme to promote port-led development, integrate coastline & waterways, reduce logistics costs, improve export competitiveness. (Wikipedia) | Push for digital solutions in ports & coastal shipping; software for port operations, port‑community systems, cargo tracking, logistics integration, perhaps even smart port dashboards. |

| Environment / Green Shipping Policies | India aims to shift inland/coastal water transport to renewable energy; green vessels, solar, battery‑operated, hydrogen vessels; set up Maritime Development Fund, green hydrogen hubs, etc. (Reuters) | Software needed for emission monitoring, energy consumption tracking, scheduling to optimise fuel use, route planning for energy efficiency; integration with environmental reporting systems. |

What are Latest Market Trends in the Waterway Transportation Software Market?

- The utilization of IoT devices and sensors is one of the emerging trends in the waterway transportation software market. This technology provides real-time monitoring of vessel conditions and cargo, offering valuable insights for enhanced safety, efficiency and decision-making. Additionally, IoT sensors are also able to track factors such as temperature, humidity, cargo integrity and engine performance.

- Predictive analytics is another emerging trend in the waterway transportation software market. It involves using advanced data analytics and AI to forecast maintenance needs and optimize shipping routes. By analyzing historical and real-time data, predictive analytics are able to predict when vessels and equipment require maintenance, minimizing downtime and reducing operational costs. It also aids in route optimization, allowing for efficient navigation, reduced fuel consumption and on-time deliveries, contributing to improved overall performance of waterway transportation.

- The market also benefits from the rising demand for cloud-based platforms and SaaS models. These solutions allow seamless access to real-time data across ports and vessels. It enhances scalability while lowering upfront infrastructure costs for operators. SaaS-based tools provide regular updates, thus improving security and performance.

- There is a rising focus on green shipping initiatives. Software platforms now include modules for emissions tracking and fuel optimization. This helps companies comply with stricter environmental regulations while simultaneously lowering their carbon footprints. Shipping operators are increasingly integrating sustainability metrics into performance dashboards to align with global sustainability commitments.

Market Dynamics

Driver

Technological Advancements

One of the primary drivers fueling the growth of the waterway transportation software market are advancements in technology, the push for sustainability and increasing global trade. Technological innovations such as the integration of IoT devices, Artificial Intelligence and Big Data analytics are revolutionizing waterway transportation operations. These tools help in real-time tracking, predictive maintenance, route optimization and improved fleet management.

As global trade continues to expand, companies are actively seeking innovative ways to streamline their operations, reduce costs and enhance supply chain efficiency. The application of software solutions in this sector is becoming vital for optimizing route planning, cargo tracking and fleet management. By utilizing such advanced technologies and systems, businesses can improve operational efficiency and make informed decisions.

- Additionally, the rising need for compliance with regulatory frameworks and sustainability initiatives has led to increased adoption of software and in turn, has driven up the market. This supports operational transparency and efficiency in the waterway transportation sector.

Restraint

High Initial Investments and Complexities

Despite the positive growth factors, the waterway transportation software market faces several restraints. One of the key challenges is the high initial investment required for implementing advanced software solutions. Smaller companies or those who have limited budgets may struggle to adopt these technologies, slowing down market penetration.

Additionally, the complexity of integrating new software with existing infrastructure can also pose to be a challenge. Legacy systems that are prevalent in older shipping companies may not be easily compatible with new technologies, leading to additional costs and operational delays.

Furthermore, the waterway transportation industry has stringent government regulations and policies, which can slow down the adoption of these new technologies. Different regions have varying standards for vessel operations, safety protocols, and environmental regulations, making it difficult for software providers to create solutions that cater to all regions.

Opportunity

Investments and Sustainability

Governments globally are increasingly recognizing the importance of maritime transportation in boosting economic growth and enhancing international trade. As a result, there is substantial investment in maritime infrastructure, including ports, canals and waterways. This investment creates a favorable environment for the market to grow and develop.

Enhanced infrastructure not only improves the efficiency of waterway transportation but also necessitates the deployment of advanced software services for effective management and operations. As ports and waterways become modernized, the demand for integrated software solutions that can optimize asset utilization and enhance overall service delivery will also continue to increase.

Another key opportunity arises is due to the expanding trend of eco-friendly shipping. As governments around the world impose stringent environmental regulations, the demand for solutions that enable fuel efficiency and emissions reduction is also on the rise.

This is pushing the market toward the development of software tools that can optimize shipping routes, manage fuel consumption and monitor environmental compliance. The push for sustainability is not just regulatory but is also being driven by a growing consumer preference for environmentally friendly products and services.

More Insights of Towards Automotive:

- Generative AI in Automotive Market Drives at 23.50% CAGR (2025-34) - The GenAI in automotive market is projected to reach USD 33.84 billion by 2034, growing from USD 5.06 billion in 2025.

- U.S. Truck Bed Accessories Market Drives at 7.15% CAGR (2025-34) - The U.S. truck bed accessories market is forecast to grow from USD 2.79 billion in 2025 to USD 5.19 billion by 2034.

- Fleet Decarbonization Market Drives at 7.15% CAGR (2025-34) - The fleet decarbonization market is projected to reach USD 797.96 billion by 2034, expanding from USD 428.6 billion in 2025.

- Pickup Trucks Market Drives at 5.56% CAGR (2025-34) - The pickup trucks market is forecasted to expand from USD 232.23 billion in 2025 to USD 377.93 billion by 2034, growing at a CAGR of 5.56% from 2025 to 2034.

- Electric Utility Terrain Vehicles (UTV) Market Drives at 22.87% CAGR (2025-34) - The electric UTV market is forecasted to expand from USD 84.00 million in 2025 to USD 368.53 million by 2034, growing at a CAGR of 22.87% from 2025 to 2034.

- Electric ATV Market Size and Growth Forecast 2034 - The global electric ATV market is projected to reach USD 352.4 million by 2034, growing from USD 36.92 million in 2025, at a CAGR of 28.49% during the forecast period from 2025 to 2034.

- Motorsport Transmission Market Drives at 9.59% CAGR (2025-34) - The motorsport transmission market is forecasted to expand from USD 271.29 million in 2025 to USD 618.55 million by 2034.

- Electric Vehicle (EV) Testing, Inspection and Certification Market Drives at 9.25% CAGR (2025-34) - The electric vehicle (EV) testing, inspection, and certification market is forecasted to expand from USD 4.65 billion in 2025 to USD 10.32 billion by 2034.

- Automotive Infotainment Testing Market Drives at 6.88% CAGR (2025-34) - The automotive infotainment testing platform market is projected to reach USD 3.93 billion by 2034, growing from USD 2.16 billion in 2025.

- L(M)FP Batteries Market Trends Funding Activities and Industry Participants - The L(M)FP batteries market is accelerating, with forecasts predicting hundreds of millions in revenue growth between 2025 and 2034.

Regional Analysis

Why is North America dominating the market?

North America dominated the waterway transportation software market in 2024. The growing adoption of electric yachts among high-net worth individuals (HNIs) in countries like the U.S. and Canada has boosted market expansion. The region also benefits from numerous government initiatives which are aimed at developing the port infrastructure coupled with rapid deployment of cloud-based fleet management software in modern ports. Moreover, the presence of several market players such as IBM, Oracle, cruisePAL and some others is expected to propel the growth of the waterway transportation software market in this region.

U.S Market Drivers:

- The U.S Inland waterways system, especially along the Mississippi and Great Lakes is pushing software adoption in order to optimize efficiency and reduce bottlenecks.

- The country’s waterway transport is increasingly being integrated with rail and trucking, creating a need for advanced analytics and tools to synchronize with supply chains.

- With federal attention on critical infrastructure security, there is a high focus on cybersecurity. Operators are adopting software that have strong cyber protections, vessel tracking as well as reporting systems.

- The country is also pushing for autonomy and remote operations. Trials of semi-autonomous and remotely assisted inland vessels are increasing demand for advanced systems and platforms.

What are the Advancements in Asia-Pacific?

Asia Pacific is expected to rise at the fastest rate during the forecast period. The rising development in the water transportation sector coupled with rapid integration of advanced technologies such as AI and IoT in fleet operations has driven the market growth. Also, the growing investment by government of various countries such as India, China, Japan, South Korea and some others is contributing to the industrial expansion. Moreover, the presence of numerous water transportation software companies such as Samsung, Fresa Technologies, Vinova Pte Ltd etc. is expected to drive the growth of the waterway transportation software market in this region even more.

China Market Drivers:

- China’s ministry of transport is actively supporting digitalization of inland waterways, making the adoption of real time tracking and compliance tools a priority.

- Major ports such as Shanghai and Wuhan are integrating digital platforms that connect vessels with port operators, boosting demand for resource management modules.

- China’s local software vendors and state backed cloud providers are making affordable maritime solutions available, fueling adoption among small scale operators.

- The country’s expansion of the e-commerce supply chain into interior provinces is driving the need for accurate and efficient cargo visibility across rivers and canals.

Get the latest insights on automotive industry segmentation with our Annual Membership: https://www.towardsautomotive.com/get-an-annual-membership

Segmental Analysis

Application Insights

Which application dominated the market this year?

The fleet management segment led the waterway transportation software market. The increasing use of advanced software to manage and track fleets of ships has boosted the market expansion. Additionally, the growing demand for fleet management software from shipping companies for several functions including voyage planning, fleet tracking, crew management, fleet optimization and some others is adding to the overall industrial expansion. Moreover, the rising adoption of AI-based fleet management software by fleet operators is driving the growth of the waterway transportation software market.

The cargo tracking segment is expected to grow with the highest CAGR during the forecast period. The rising demand for advanced cargo tracking software from logistics companies has boosted the market growth. Additionally, the increasing application of this software for enhancing several applications such as real-time tracking, status updates, predictive analytics, decision making and some others is playing a vital role in shaping the industrial landscape. Moreover, the rapid deployment of AI-enabled cargo tracking software in logistics carriers has driven the growth of the waterway transportation software market.

Elevate your automotive strategy with Towards Automotive. Enhance efficiency and achieve superior results - schedule a call today: https://www.towardsautomotive.com/schedule-meeting

Deployment Insights

Which deployment segment dominate the market?

On-premise platforms remain relevant for large shipping companies and port operators that demand full control over sensitive operational data. It ensures security and compliance in regions with strict regulatory requirements. On-premises solutions continue to attract organizations seeking greater control over their data and systems, enhancing security and customization options. Their dominance remains due to the fact that large shipping and port authorities have always traditionally relied on in house systems for data control and regulatory compliance.

Cloud-Based deployments are increasingly popular due to their scalability and reduced infrastructure costs, providing flexibility and efficiency. Cloud-based models record rapid adoption, driven by flexibility, lower upfront costs, and easy scalability. Small and medium-sized enterprises favor cloud deployment for its real-time access and reduced IT burden. The advantage of this segment comes from its ability to support real time data sharing across multiple locations.

Functionality Insights

Which functionality segment dominate the market in 2024?

Real time tracking dominated the market this year. This is because shipping and logistics operators prioritize visibility across global routes. The growing complexity of maritime supply chains combined with rising customer expectations for precise and timely delivery has driven the adoption of this segment. It includes advanced GPS, AIS and IoT enabled tracking platforms. It helps to reduce risks of cargo theft, ensures compliance with international shipping regulations as well as enhances port to port operational efficiency.

Compliance management is expected to be the fastest growing segment in 2024. Its growth is driven by increasingly stringent environmental and safety regulations. New standards such as the IMO 2020 for sulfur emissions, ballast water management conventions and carbon reduction initiatives are compelling operators to adopt compliance focused software. They help to reduce manual errors, streamline reporting and ensure operators avoid costly penalties while also maintaining sustainability goals, thus making it popular.

End Use Insights

Which end user led the market in 2024?

The logistics companies segment dominated the market. The growing investment by logistics providers to integrate advanced software in shipping sector has driven the market growth. Additionally, the rising emphasis of logistics brands to deliver products internationally without any error and misplacement is further adding to the industrial expansion. Moreover, numerous market players are launching advanced software to track vessels in isolated ocean parts, thereby driving the growth of the waterway transportation software market.

The port authorities segment is expected to rise with a significant CAGR during the forecast period. The growing investment by port authorities to deploy advanced software for managing port operations has boosted the market expansion. Additionally, partnerships among port authorities and software providers to integrate advanced fleet management software in modern ports is further adding to the overall industrial expansion. Moreover, the rising cases of thefts and burglary in ports has increased the demand for safety management software, thereby driving the growth of the waterway transportation software market.

Access our exclusive, data-rich dashboard dedicated to the Waterway Transportation Software Market designed specifically for decision-makers, strategists, and industry leaders. Towards Automotive dashboard offers in-depth statistical insights, segment-wise market analysis, regional share breakdowns, comprehensive company profiles, annual updates, and much more. From market sizing to competitive benchmarking, this all-in-one platform is your strategic gateway to smarter, data-driven decisions.

Access Now: https://www.towardsautomotive.com/contact-us

Top Key Players in Waterway Transportation Software Market

- ABS Wavesight

- Accenture Plc

- Bass Software Ltd.

- Cognizant Technology Solutions Corp.

- Descartes Systems Group

- DNV GL

- Flexport Inc.

- IBS Software

- Oracle Corporation

- SAP SE

Recent Developments

- In February 2025, Freight Technologies launched Fleet Rocket. Fleet Rocket is a Transportation Management System designed for enhancing freight management operations across the USMCA region. Their new TMS combines powerful features, seamless integrations and fast implementation to create real value for clients through reduced costs and risks, improved decision-making and operational efficiency and elevated overall supply chain management performance.

- In August 2025, Vigor Marine Group (VMG) announced a strategic partnership with Samsung Heavy Industries (SHI) that will bring expanded forward-deployed maintenance, repair, and overhaul (MRO) capacity to the Indo-Pacific region, offering the U.S. Navy and Military Sealift Command (MSC) a compelling new option to keep vessels mission-ready. In addition, the two leading companies may explore opportunities to support a U.S. shipbuilding renaissance, including a return to Vigor Marine Group’s shipbuilding roots in the Pacific Northwest.

Segments Covered in the Report

By Application

- Fleet Management

- Cargo Tracking

- Port Management

- Safety Management

By Deployment

- Hybrid

- Cloud-based

- On-Premises

By Functionality

- Real-Time Tracking

- Reporting Analytics

- Resource Management

- Compliance Management

By End Use

- Logistics Companies

- Shipping Lines

- Port Authorities

- Government Agencies

By Region

- North America

- Latin America

- Europe

- Asia Pacific

- The Middle East and Africa

Invest in Our Premium Strategic Solution: https://www.towardsautomotive.com/price/1126

Become a Valued Research Partner with Us - Schedule a meeting: https://www.towardsautomotive.com/schedule-meeting

Request a Custom Case Study Built Around Your Goals: sales@towardsautomotive.com

About Us

Towards Automotive is a leading research and consulting firm specializing in the global automotive industry. We deliver actionable insights across key segments such as electric vehicles (EVs), autonomous driving, connected cars, automotive software, aftermarket services, and more. Our expert team supports both global enterprises and start-ups with tailored research on market trends, technology, and consumer behavior. With a focus on accuracy and innovation, we empower clients to make informed decisions and stay competitive in a rapidly evolving landscape.

Stay Connected with Towards Automotive:

- Find us on Social Platforms: LinkedIn | Twitter | Instagram

- Subscribe to Our Newsletter: Towards AutoTech

- Read Our Printed Chronicle: Automotive Web Wire

- Visit Towards Automotive for In-depth Market Insights: Towards Automotive

- APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44

- Get ahead of the trends – follow us for exclusive insights and industry updates: Tumbler | Bloglovin | Medium | Hashnode | Pinterest

Towards Automotive Releases Its Latest Insight - Check It Out:

- Fuel Cell Electric Vehicle Market Research, Trends and Forecast by 2034

- Automotive Software Market Review, Key Business Drivers and Industry Forecast

- Electric Vehicle Power Inverter Market Growth, Demand, and Production Forecast 2034

- Hydrogen Fuel Cell Vehicle Market Share, Trends and Key Players

- Compact Agricultural Tractors Market Trends, Challenges & Strategic Recommendations

- Amphibious Vehicle Market Outlook Scenario Planning & Strategic Insights for 2034

- Car Wheel Cap Market Intelligence Report, Key Trends, Innovations & Market Dynamics

- Forklift Rental Market Growth Drivers, Challenges, Opportunities and Leading Players

- Automotive Variable Oil Pump Market Growth Drivers, Challenges and Opportunities

- Robotaxi Market Size, Share, Growth Projections & Major Players

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.