Payments Market Competition Analysis 2025: How Players Are Shaping Growth

The Business Research Company's Payments Global Market Report 2025 – Market Size, Trends, And Global Forecast 2025-2034

LONDON, GREATER LONDON, UNITED KINGDOM, December 18, 2025 /EINPresswire.com/ -- "The Payments market is dominated by a mix of global financial institutions, fintech innovators, and regional payment solution providers. Companies are focusing on real-time transaction processing, secure digital payment infrastructure, and customer-centric financial solutions to strengthen market presence and drive adoption. Understanding the competitive landscape is key for stakeholders seeking growth opportunities, strategic partnerships, and technological differentiation in an increasingly digital and interconnected payments ecosystem.

Which Market Player Is Leading the Payments Market?

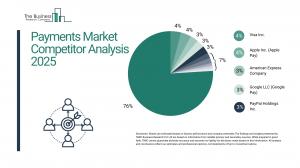

According to our research, Visa Inc. led global sales in 2023 with a 4% market share. The Digital payments division of the company partially involved in the digital payments, catering to consumers, merchants, and financial institutions. Their offerings include credit, debit, and prepaid cards, as well as advanced payment solutions like Tap to Pay and Click to Pay, which enhance transaction convenience and security. Visa provides innovative services such as the Visa Payment Passkey Service, which utilizes biometric data for secure online payments, and data tokenization to protect sensitive information during transactions.

How Concentrated Is the Payments Market?

The market is fragmented, with the top 10 players accounting for 25% of total market revenue in 2023 . This level of fragmented reflects the highly competitive landscape driven by diverse geographic presence and varied consumer preferences. Leading players such as Visa Inc, Apple Inc. (Apple Pay), American Express, Google LLC (Google Pay), PayPal, and Mastercard dominate through trusted brand recognition, broad payment networks, and innovative digital payment solutions, while smaller firms cater to niche segments and emerging markets. As digital payments adoption accelerates globally, strategic partnerships, acquisitions, and technological innovations are expected to further consolidate market leadership among the top players.

Leading companies include:

o Visa Inc. (4%)

o Apple Inc. (Apple Pay) (4%)

o American Express Company (3%)

o Google LLC (Google Pay) (3%)

o PayPal Holdings Inc. (3%)

o Mastercard Incorporated (1%)

o Discover Financial Services Inc. (2%)

o Tencent Holdings Ltd. (WeChat Pay) (2%)

o Fiserv Inc. (1%)

o JPMorgan Chase & Co. (1%)

Request a free sample of the Payments Market report:

https://www.thebusinessresearchcompany.com/sample_request?id=107&type=smp

Which Companies Are Leading Across Different Regions?

North America: Moneris Solutions Corporation, TD Bank Group, Banamex (Banco Nacional de México S.A.), Citigroup Inc, Global Payments Inc, Banco Santander México S.A. (Santander México), Grupo Financiero Banorte S.A.B. de C.V, Visa Inc, Mastercard Incorporated, PayPal Holdings Inc, American Express Company, and Fiserv Inc are leading companies in this region.

Asia Pacific: Alipay Co, Ltd, JPMorgan Chase & Co, Citigroup Inc. (Citibank), Xsolla Inc, PhonePe Pvt. Ltd, Mastercard Incorporated, Visa Inc, American Express Company, Samsung Electronics Co, Ltd. (Samsung Pay), KDDI Corporation, Japan Post Bank Co, Ltd, Mitsubishi UFJ Financial Group, Inc, and Google LLC (Google Pay Inc.) are leading companies in this region.

Western Europe: FintechIO Ltd, Stripe Inc, Klarna Bank AB, Adyen N.V, Neonomics AS, Worldpay Group Ltd, and PayPal Holdings Inc are leading companies in this region.

Eastern Europe: Ceska Sporitelna AS, Komercni Banka AS, Worldline SA, Przelewy24 Sp. z o.o, Polskie ePlatnosci SA, EuroPayment Services SA, Sberbank of Russia PJSC, Tinkoff Bank JSC, VTB Bank PJSC, and Alfa-Bank JSC are leading companies in this region.

South America: MercadoLibre Inc, PagSeguro Digital Ltd, MODO Payments, Nu Holdings Ltd. (Nubank), dLocal Ltd, PicPay Serviços S.A, iZettle AB, Kushki Pagos Latam S.A, and Stelo S.A are leading companies in this region.

What Are the Major Competitive Trends in the Market?

• Flexible Financing With New Credit Card is offering a flexible payment model.

• Example: Klarna credit card in the U.S (April 2024) allow users to make purchases anywhere Visa is accepted, with flexible payment options.

• To be eligible, users must be at least 18 years old, U.S. residents and have a history of timely repayments on prior Klarna purchases.

Which Strategies Are Companies Adopting to Stay Ahead?

• Launching innovative digital payment solutions to expand service offerings

• Enhancing partnerships with fintechs and financial institutions to strengthen ecosystem presence

• Focusing on cybersecurity and fraud prevention technologies to build customer trust

• Leveraging artificial intelligence and data analytics to optimize transaction processing

Access the detailed Payments Market report here:

https://www.thebusinessresearchcompany.com/report/payments-global-market-report

The Business Research Company (www.thebusinessresearchcompany.com) is a leading market intelligence firm renowned for its expertise in company, market, and consumer research. We have published over 17,500 reports across 27 industries and 60+ geographies. Our research is powered by 1,500,000 datasets, extensive secondary research, and exclusive insights from interviews with industry leaders.

We provide continuous and custom research services, offering a range of specialized packages tailored to your needs, including Market Entry Research Package, Competitor Tracking Package, Supplier & Distributor Package and much more.

Disclaimer: Please note that the findings, conclusions and recommendations that TBRC Business Research Pvt Ltd delivers are based on information gathered in good faith from both primary and secondary sources, whose accuracy we are not always in a position to guarantee. As such TBRC Business Research Pvt Ltd can accept no liability whatever for actions taken based on any information that may subsequently prove to be incorrect. Analysis and findings included in TBRC reports and presentations are our estimates, opinions and are not intended as statements of fact or investment guidance.

Contact Us:

The Business Research Company

Americas +1 310-496-7795

Europe +44 7882 955267

Asia & Others +44 7882 955267 & +91 8897263534

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company"

Oliver Guirdham

The Business Research Company

+44 7882 955267

info@tbrc.info

Visit us on social media:

LinkedIn

Facebook

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.