Action Cameras Shift from Niche to Mass Market Amid High-Growth Trend

Action camera sales reached 4.76 million units, up +252% year-over-year, while revenue grew +316% year-over-year—significantly outpacing unit sales growth,

HONG KONG, HONG KONG, HONG KONG, December 24, 2025 /EINPresswire.com/ -- In 2025, China’s action camera market entered a phase of rapid expansion, with the product category accelerating its transformation from professional and niche toward mass-market adoption.According to Sandalwood’s monitoring of China’s e-commerce market, as of October 2025, action camera sales reached 4.76 million units, up +252% year-over-year, while revenue grew +316% year-over-year—significantly outpacing unit sales growth, reflecting strong volume expansion of mid-to-high-end products. Average Selling Price (ASP) also rose +18% year-over-year, confirming consumers’ growing willingness to invest in high-performance imaging devices.

The price structure further validates the market’s upgrade trajectory:

• RMB 1,000–2,000: Share increased from 14.2% to 19.9%, capturing entry-level users;

• RMB 2,000–3,000: Remained stable at approximately 30%, solidifying its position as the mainstream segment;

• RMB 3,000–4,000: Expanded rapidly from 16.7% to 26.1%, emerging as the most prominent growth tier in structural uplift;

• Above RMB 4,000: Slightly adjusted from 9.1% to 8.9%, maintaining a small base of professional demand.

Overall structural shifts indicate accelerated expansion in the mid-to-high-end segment, with the RMB 2,000–4,000 range now forming the core consumption band for action cameras in China.

Driven by rising participation in outdoor activities, widespread adoption of short-video creation, and growing demand for travel and lifestyle documentation, action cameras are transitioning from “professional sports gear” to “everyday recording tools,” entering a sustained growth cycle fueled jointly by scale expansion and structural upgrading.

Brand Landscape Enters a Phase of Dynamic Evolution:

High Concentration Coexists with Intense Competition

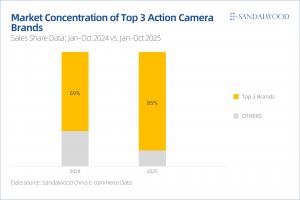

At the brand level, China’s action camera market remains dominated by specialized brands with deep technical expertise.

DJI leverages its technological strengths in drones and gimbals to establish a strong barrier in image stabilization, structural design, and adaptability to complex operating conditions. INSTA360 continuously pushes the boundaries of product form through persistent innovation in panoramic imaging, computational photography, and modular design. GoPro, with decades of deep-rooted expertise in extreme sports scenarios, maintains a professional reputation for vibration resistance, body durability, and application ecosystem robustness.

Thanks to this long-term accumulation of technical and product capabilities, the combined market share of leading brands has surged significantly—from 65% to 83%.

However, competitive dynamics across subcategories reveal that the industry structure is not yet fixed:

• In integrated action cameras, the rapid rise of INSTA360 ACE PRO 2 is encroaching on DJI’s market share;

• In the wearable camera segment, the entry of DJI OSMO NANO is exerting counter-pressure on INSTA360’s GO series;

• In panoramic cameras, DJI OSMO 360 is directly challenging the dominance of INSTA360’s ONE X series.

These shifts indicate that despite rising concentration among top brands, the market remains in a high-speed evolutionary phase, with internal competition among leaders intensifying.

In this dynamic landscape, any player—whether an established leader or a new entrant—that identifies clear scenario-based needs or pursues differentiated innovation still has realistic opportunities to carve out and establish a competitive advantage.

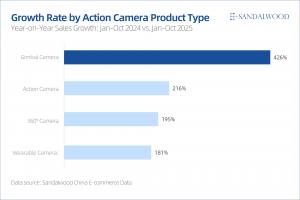

Gimbal Cameras Lead Growth,

with Multi-Scenario Innovation Becoming the Core Driver of Category Expansion

By form factor, gimbal cameras continued their strong growth momentum in 2025, now accounting for approximately one-third of the market. Among them, the OSMO POCKET 3, with its exceptional stability and ease of use, has single-handedly driven growth across the entire category, becoming the primary engine of expansion.

The rapid rise of gimbal cameras is not a fluke of viral success but rather a reflection of shifting user demands:

As content creation barriers have significantly lowered, user application scenarios are expanding from traditional sports filming to broader everyday contexts such as vlogging, travel, parenting, and lifestyle documentation; in these scenarios, users place greater emphasis on shooting success rate and overall convenience rather than professional-grade sports parameters.

Thus, the characteristics of gimbal cameras—“easy to shoot steadily, quick to master, and strong in everyday expression”—align closely with evolving user needs. Moreover, the RMB 3,000–4,000 price segment, where the flagship POCKET 3 is positioned, happens to be the fastest-growing tier in today’s market, further amplifying the category’s growth potential.

Meanwhile, the market is exhibiting a clear trend toward fragmented scenario-based demands:

Usage scenarios—including sports, vlogging, parenting, pet care, and travel—differ vastly, and no single product can satisfy all needs. Consequently, even amid the high moats built by professional brands like DJI and INSTA360, numerous “ten-million-user-scale niche scenarios” remain open for opportunity, such as pet-mounted recording, maternal/child documentation, minimalist vlogging, compact underwater filming, and extreme cold-weather outdoor shooting.

Future growth will increasingly stem from precise insights into specific scenarios and differentiated product innovation. Any brand that effectively addresses clearly defined use cases will still have the chance to establish an independent market position within a leader-dominated landscape.

Room for Restructuring Remains:

Three Accelerating Opportunities—Brand Breakthrough, Channel Expansion, and Category Synergy

The professionalization level of action cameras is rapidly advancing.

According to Sandalwood’s China e-commerce market monitoring, comparing January–October 2025 with the same period in 2024:

• Electronic image stabilization (EIS) penetration dropped from 64% to 59%;

• Gimbal-based stabilization rose from 20% to nearly 30%, making stability a core experiential focus;

• Adoption of large sensors (1/1.3ʺ and 1/1ʺ) surged from 46% to 73%, significantly raising the ceiling for image quality;

• 12MP resolution models increased from 27% to 34%, with higher-resolution segments also growing, collectively enhancing overall image sharpness and dynamic range.

Looking ahead, if other consumer electronics manufacturers choose to enter the action camera space, they will find a viable entry window during this critical juncture of market growth and structural transition.

Take smartphone brands as an example: they possess mature foundational capabilities in imaging algorithms, ISP processing, lightweight design, and sensor integration. Action cameras, in turn, overcome physical limitations inherent to smartphones—such as size constraints, thermal dissipation, lens placement, and structural rigidity—to deliver capabilities smartphones cannot achieve in stabilization, field of view, wearable form factors, and extreme-environment adaptability. This creates a natural technological complementarity between the two categories.

If seamless product synergy and ecosystem interoperability (e.g., real-time monitoring, cross-device editing, intelligent scene recognition) are realized, a powerful combination of “smartphone as primary device + action camera as front-end capture tool” could emerge, elevating the overall

Carson Collins

Sandalwood Advisors Limited

+1 4152343544

email us here

Visit us on social media:

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.